South Carolina

South Carolina's Veteran Benefits

South Carolina provides for the needs of its resident veterans and active duty military personnel with a variety of benefits, including VA loans, tax exemptions, free tuition for the children of qualified veterans, a relief fund, free and discounted licenses, veteran nursing homes, and more.

For more details, keep reading! We hope you find at least one benefit you didn't know about so it can improve your life in South Carolina.

South Carolina Residents Save

$173/mth

Savings based on 2015 active loan data

74Gallons of Gas

*Price-per-gallon based on CNN Money

21Lunches

*Based on an average lunch price of $8.08

Veteran Home Loans

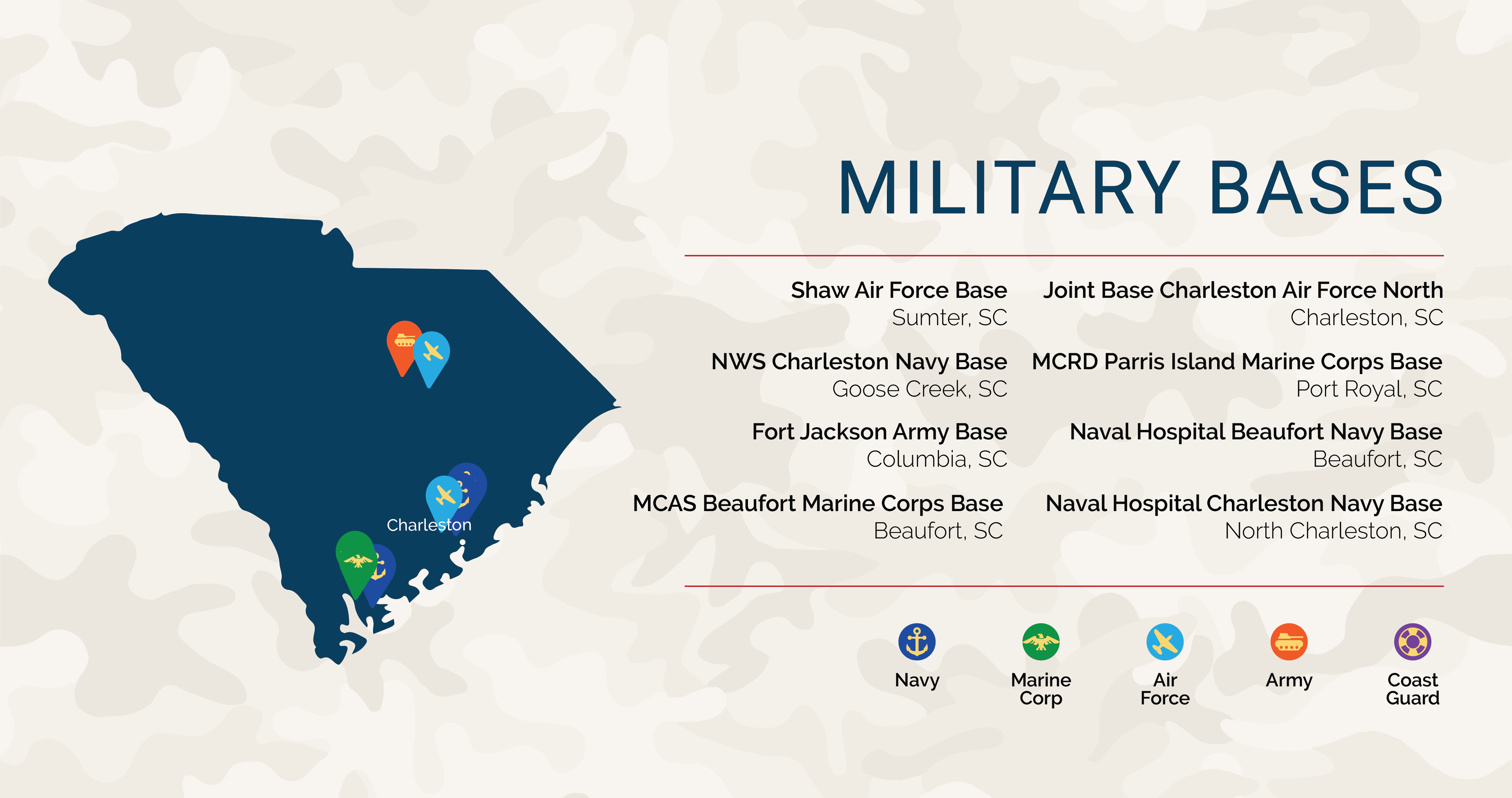

If you're a member of the Marines, Army, Coast Guard, or Air Force stationed in South Carolina, or if you're a resident who serves in the state's National Guard, you should consider buying a home near one of the state's military bases.

Whether you're a veteran living in South Carolina or are stationed at a South Carolina base, you could be eligible to get a VA loan, which is a type of home mortgage.

VA Loans & South Carolina's County Limits

Because the U.S. Department of Veterans Affairs (VA) guarantees a portion of each VA loan, eligible veterans and military personnel everywhere in the US can enjoy favorable terms and interest rates. To apply for a VA loan, contact a reliable VA-approved lender, like Low VA Rates, who helps current military servicemembers and veterans in South Carolina.

The key advantages of VA loans are:

- Easier qualifications than many other loan types

- No need to save up for a down payment

- Lower interest rates than the rates for most mortgages

- No private mortgage insurance (PMI) payments required

Depending on several factors, the amount of the loan you may qualify for will change. Even the area of the US you live in can change the amount, since different counties have different VA loan limits.

Learn more about this key housing benefit on our VA loans page, or call us at 866-569-8272.

Veteran Housing Benefits

Property Tax Relief

South Carolina veterans may be exempt from paying property taxes on their homes if they have been completely and permanently disabled—a condition which is determined by the VA, the Social Security Administration, or another government agency. A surviving spouse can use a property tax exemption, and it can be transferred when a veteran buys a different house.

Veterans may also be exempt from property taxes on residences which have been specially adapted for their disabilities, especially if they can't use their lower extremities or have been paralyzed on one-half of their bodies because of a brain injury.

South Carolina Veterans Homes

Veterans who have been honorably discharged and are residents of South Carolina may be eligible to use one of the state's three veterans homes, which are in Waterboro, Columbia, and Anderson. These facilities serve veterans who need intermediate or skilled nursing care. Patients from all over the state reside in these homes.

Veteran Employment & Education Benefits

Employment Benefits

Veterans Preference

Veterans who were honorably discharged from any branch of military service are given preference when interviewing for government jobs in South Carolina. This means they are some of the first in line for an interview and they receive extra points on any exam they might have to take during the interview process.

Operation Palmetto Employment

This is a program that helps veterans, active duty servicemembers, and their family members to find civilian work. By partnering with South Carolina state agencies, workforce development organizations, educators, and others, it aims to help reduce veteran unemployment in South Carolina.

This program also promotes veterans to employers, based on the idea that veterans' military service gives them valuable skills and experience in the workplace.

If you're a veteran, you can use their resources to find a job, non-paid work experience, or a training program. In a non-paid work experience, you can gain marketable skills by training at a workplace, and the employer (a federal, state, or local government agency) can take time to decide if you're right to continue in that position.

In on-the-job training and apprenticeships programs, you can get training while being paid, and you can use your GI Bill benefits to support your learning. During training—if not at a government position—you can climb through levels of higher pay until you gain journeyman status or a job certification.

Credit Toward State Retirement

If you are a state employee and called to active duty in the military, you can continue to make payments to your state retirement program, allowing you to stay in the program. You can also get credits that you have earned by your military service applied to your state retirement plan.

Education Benefits

Free Tuition for Children of Certain Veterans

South Carolina provides free tuition to state-supported higher education institutions and technical schools. This is for the children of war veterans who died in the service or because of their service, were or are missing in action or prisoners of war, are completely and permanently disabled, were awarded the Medal of Honor, or were awarded a Purple Heart. Eligibility is based on residency and may include other requirements.

Other Veteran Benefits

South Carolina Military Family Relief Fund (SCMFRF)

This fund makes grants available to South Carolina families who have a member in the South Carolina National Guard or in the U.S. Armed Forces Reserve components who went into active duty after September 11, 2001.

These grants are meant to relieve the financial problems families face when a family member starts to receive a far reduced salary in the military when compared to a non-military salary. The grant can help pay for housing, utilities, medical care, food, and other expenses.

Benefits include flat-rate grants of $500 or $1,000 or a need-based grant of up to $2,000. Download the application to see the requirements, including eligibility.

Hunting & Fishing Licenses

Free fishing and hunting licenses are available to residents veterans who are completely disabled.

Non-disabled veterans can also enjoy reduced fees for licenses compared to civilians of a similar background. For example, active duty residents who are back in the state on leave can simply fish or hunt without purchasing a license. And non-resident military personnel stationed in South Carolina can enjoy the resident rate for a fishing or hunting license.

Reduced Rates on State Parks

Completely and permanently disabled veterans who are residents of South Carolina (as well as active South Carolina National Guard members) can enter South Carolina state parks half the cost of a regular state parks pass.

This discounted pass is called the Palmetto Passport, and it cannot be purchased online. It must either be purchased via telephone or in person at any state park, the State Park Central Office, or at the State House Gift Shop.

South Carolina Veterans Cemetery

Honorably discharged South Carolina veterans and their spouses can be interred at the M.J. "Dolly" Cooper Veterans Cemetery in Anderson. Interment is free for veterans, and there is a small charge for spouses.

Veterans can send in their discharge documents and marriage certificate, if applicable, in order to be pre-certified for interment when the time comes, which reduces stress. Residency requirements apply.

Active Duty Income Tax

According to state law, South Carolina residents who are on active duty are taxed on their military pay, but National Guard and Reserve members who receive drill pay are not taxed on that income.

In addition, non-resident military personnel from other states who are stationed in South Carolina don't have to pay South Carolina income tax on their military pay. If they have spouses who work in South Carolina, though, the spouses' pay is subject to South Carolina income tax.

Military Retirement Pay Income Tax Deduction

If you're a South Carolina veteran receiving military retirement pay, you can deduct a certain amount of that pay from your gross income when you file your state income tax. If you're a surviving spouse, you can instead deduct a portion of your survivors benefits. The amount you can deduct will increase every year until the year 2020, when the changes are scheduled to stop.

For veterans 64 years old and younger, the amount you can deduct each year will be:

- $11,700 in 2018

- $14,600 in 2019

- $17,500 in 2020

For veterans 65 years old and older, the amount you can deduct each year will be:

- $24,000 in 2018

- $27,000 in 2019

- $30,000 in 2020

Presentation of the State Flag

The family of deceased members of the South Carolina National Guard can receive a South Carolina state flag from the State Adjutant General's Office. This flag can be used as a burial flag.

A family member of the deceased must apply for the flag by contacting the South Carolina Division of Veterans' Affairs.

Military License Plates

Military personnel and veterans can receive special license plates from the South Carolina Department of Motor Vehicles to show their military history or affiliation. There may be a registration fee. These plates include:

- U.S. Armed Forces Retiree

- Marine Corps League

- National Guard

- National Guard Retirees

- Disabled Veterans

- Pearl Harbor Survivors

- Normandy Invasion Survivors

- Purple Heart Recipients

- Ex-Prisoners of War

- Medal of Honor Recipients

Many more are available. Eligibility may require documents proving your specific military history. These plates may also be available to military spouses.

Veteran Benefits Assistance

The South Carolina Division of Veterans' Affairs exists to help South Carolina's veterans through services and programs. These include:

- Educating South Carolina's military veterans, survivors, and families about their available benefits

- Helping veterans apply for their benefits

- Responsibility for the South Carolina Free Tuition Program

- Helping to manage South Carolina's veterans nursing homes

- Managing South Carolina's war roster

- Overseeing the South Carolina state veterans cemetery

- Managing the South Carolina Military Family Relief Fund (SCMFRF)

- Answering questions about benefits for veterans and military personnel

- Organizing the South Carolina Veterans Advocacy Council

The South Carolina Division of Veterans' Affairs helps veterans from all types of service with their claims for benefits, from the initial application to the final decision. These claims may be for medical care, financial help, education, or insurance benefits.

The South Carolina VA can also help veterans' parents, surviving spouses, children, and orphans. Some of these services include helping veterans' children to receive free tuition, when applicable.

About Low VA Rates

Low VA Rates specializes in serving those who have served us. From the day we were founded, we have made it our mission to help veterans and active duty military personnel find the VA home loans they need.

If you're shopping for South Carolina veteran loans, call Low VA Rates for a free quote. A friendly and professional team member will work to understand your specific needs and match you with the right VA loan, whether you're buying a home, refinancing, repairing, upgrading, or building. Call us at (866) 569-8272, or get an application started online.

© 2024 Low VA Rates, LLC™.

All Rights Reserved. Low VA Rates, LLC is not affiliated with any U.S. Government Agency nor do we represent any of them. Corporate Address: 384 South 400 West, Suite 100, Lindon, UT 84042, 801-341-7000. VA ID 979752000 FHA ID 00206 Alaska Mortgage Broker/Lender License No. AK-1109426; Arizona Mortgage Banker License #0926340; Licensed by the Department of Financial Protection and Innovation under the California Finance Lenders Act License #603L038; Licensed by the Delaware State Banking Commission License #018115; Georgia Residential Mortgage Licensee License #40217; Illinois Residential Mortgage License #MB.6761021; Licensed by the New Jersey Department of Banking and Insurance, Ohio Mortgage Loan Act Certificate of Registration #RM-501937.000; Oregon Mortgage Lending License # ML-5266; Rhode Island Licensed Mortgage Lender License #20143026LL; Texas License LOCATED at 201 S Lakeline Blvd., Ste 901, Cedar Park, TX 78613; EAH032221 NMLS ID# 1109426 NMLS Consumer Access

© 2024 Low VA Rates, LLC™.

All Rights Reserved. Low VA Rates, LLC is not affiliated with any U.S. Government Agency nor do we represent any of them. Corporate Address: 384 South 400 West, Suite 100, Lindon, UT 84042, 801-341-7000. VA ID 979752000 FHA ID 00206 Alaska Mortgage Broker/Lender License No. AK-1109426; Arizona Mortgage Banker License #0926340; Licensed by the Department of Financial Protection and Innovation under the California Finance Lenders Act License #603L038; Licensed by the Delaware State Banking Commission License #018115; Georgia Residential Mortgage Licensee License #40217; Illinois Residential Mortgage License #MB.6761021; Licensed by the New Jersey Department of Banking and Insurance, Ohio Mortgage Loan Act Certificate of Registration #RM-501937.000; Oregon Mortgage Lending License # ML-5266; Rhode Island Licensed Mortgage Lender License #20143026LL; Texas License LOCATED at 201 S Lakeline Blvd., Ste 901, Cedar Park, TX 78613; EAH032221 NMLS ID# 1109426 NMLS Consumer Access